news

Achisomoch Blog

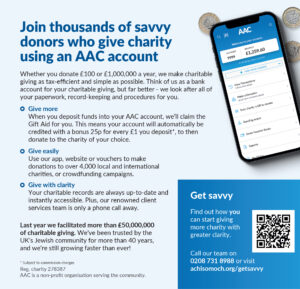

GetSavvy

Winter 2022

This page and the 7 sections below are to help you understand how AAC works and the benefits. If you are ready to open an account now please explore your account options and sign up

1. Giving charity – am I doing it in the best way?

So, how do you give charity?

A few coins in a collection box? By a cheque or cash handed into the charity? Over the phone with a card? A cheque sent by post?

Well, in the olden days, that’s how we used to do it.

If this is how you are giving charity today, consider:

- How much of your time does it take to make a donation – especially if it is a larger amount?

- Do you know how much you gave in total last month? What about last year?

- Do you know how much you gave to this charity last time?

- Do you know when you gave to this charity last?

- Do you set up Standing Orders? If so, can you review them in a single report?

- Are you sure you’re giving to a valid, compliant, charity?

- How can you donate to the growing number of online crowdfunding campaigns?

Today, savvy givers use AAC to give tax-efficient donations online in seconds, using their smartphone, – and to charities around the world.

All charities are vetted by AAC, and if you are a UK tax payer you automatically get an extra ‘reward’ added to anything you donate – all done by someone else.

2. So, how does AAC work?

You consolidate all of your charity giving through a single point – your AAC account. Think of it as a bank account to be used for all your charity giving.

As with any bank, you can make deposits into your account. You can also arrange for (or advise) the bank to pass money from your account to any charity vetted by our high standard compliance team (that’s why this service is often called a Donor Advised Fund or DAF). Again, as with any bank you can do that with a cheque (what we call a ‘voucher’), online, with our app, or even via a crowdfunding website’s payment page. We can even give you a book of low value charity vouchers (50p, £1, £2) to give out from your account – instead of cash.

You don’t even need to keep records – it’s all shown in your account with customisable reports and regular statements!

3. What’s Gift Aid anyway? How can I get an extra 25% from my giving?

Over 50 years ago, the UK introduced a concept now known as a Covenant or Gift Aid. It was a ‘present’ from the government so that if you are a tax payer and made a charitable donation, they would refund to the charity the tax you had paid. So, if you gave £100 to a charity, you probably earned £125, paid tax, and used the left over £100 as a grant to the charity. The charity could now claim the GIft Aid from HMRC, and receive a top up present of £25!

As a charity itself, AAC claims the Gift Aid for you – regularly, automatically and quickly – crediting your account so that you can choose which charity benefits from this bonus money.

4. Trusted for over 45 years, and growing faster than ever

As of Winter 2022, we are the largest such Donor Advisory Fund that serves the Jewish world, distributing over £50M per year of our clients’ funds.

Here’s some reasons why our clients are so loyal:

- Superb customer service: We normally respond to phone calls under two minutes; to emails within three hours; and we are often available outside office hours and on Sundays.

- We run our operation efficiently: overhead charges are well under 1.5% of turnover.

- Our profits are distributed to Jewish educational causes: Last year, almost £900,000 was gifted. These profits are derived from the small ‘bank’ charges on accounts, which keep the AAC engine going.

- Our technology is advanced and user-friendly: We offer an advanced, renowned app and online platform with multi-user access.

- We offer Give As You Earn (which allows you to give charity from your salary before tax is deducted).

- You’ll have clarity on your giving: Apart from regular statements (on paper, in your online account, and in Excel), we offer some interesting reports about your giving: How much, when, to who, and more.

5. I already make tax deductible donations from my company – what benefit is AAC to me?

Using AAC means one receipt for your annual returns – you will no longer need to chase for and file each individual charity receipt. You will also have the benefit of making international donations, as well as the peace of mind that AAC are taking care of all the compliance regulations of charity giving.

6. How to get started:

Simply apply for an account using the below links – we’ll do a few checks and give you online access to your account. You can then send through your initial payment which will show up in your account within a few hours. You can be up and running within a day.

7. Explore what type of account is best for you:

- A personal account

- A company or charitable trust account (you would be surprised to know how many people have opted to use AAC rather than run their own fund with the high cost of compliance, bookkeeping and reporting)

- Payroll GAYE account

For more information, read below or call our savvy client services team on 020 8731 8988 or email admin@achisomoch.org.

Now’s the time to join the over 2500 savvy givers in North West London alone.